Love them or hate them, Fox News Network has raised many issues that concern all North American’s. Since John Stossel arrived at the Fox News Network, he has covered many touchy subjects. One of the tougher realities he raised was about crony capitalism.

Stossel had a TV programme about Judge Richard Posner, the intellectual who released his book, “A Failure of Capitalism: The Crisis of ’08 and the Descent into Depression”. It was published last year. Judging by the noise in the market, people must have thought the final verdict was cast. Capitalism caused the economic down turn and high unemployment.

That this verdict was pronounced by someone like Professor Posner, who is associated with the University of Chicago and the free-market law and economics movement, gave moral support to all the politicians who were intent on exploiting the recession (as they exploit all crises) to increase government control of the economy.

Why is "capitalism" blamed?

The word "capitalism" is used in two contradictory ways. Sometimes it's used to mean the free market, or laissez faire. Other times it's used to mean today's government-guided economy. Logically, "capitalism" can't be both things. Either markets are free or governments control them. We can't have it both ways.

The truth is that we do not have a free market -- government regulation and management are pervasive -- so it is misleading to say that "capitalism" caused today's problems. The free market is innocent. But it is fair to say that crony capitalism created the economic mess.

What is crony capitalism?

It's the economic system in which the marketplace is substantially shaped by a cozy relationship among government, big business and big labour. Under crony capitalism, government bestows a variety of privileges that are simply unattainable in the free market, including import restrictions, bailouts, subsidies and loan guarantees.

Crony capitalism is as old as Canada itself. One of the first pieces of legislation passed by Parliament in 1867 was a tariff on foreign goods to protect influential domestic business interests.

We do not have to look far to see how crony-dominated North American capitalism is today. The politically connected tire and steel industries get government relief from a "surge" of imports from China. Who cares if North American consumers want to pay less for Chinese steel and tires?

Crony capitalism, better know as government bailouts, saved General Motors and Chrysler from extinction. The Barack Obama cronies at the United Auto Workers are getting preferential treatment over other creditors and generous stock holdings (especially outrageous considering that the union helped bankrupt the companies in the first place with fat pensions and wasteful work rules).

Banks and insurance companies (like AIG) were bailed out because they were deemed too big to fail. Favoured farmers get crop subsidies.

If free-market capitalism is a private profit-and-loss system, crony capitalism is a private-profit and public-loss system. Companies keep their profits when they succeed but use government to stick the taxpayer with the losses when they fail. Great concept if it works for you.

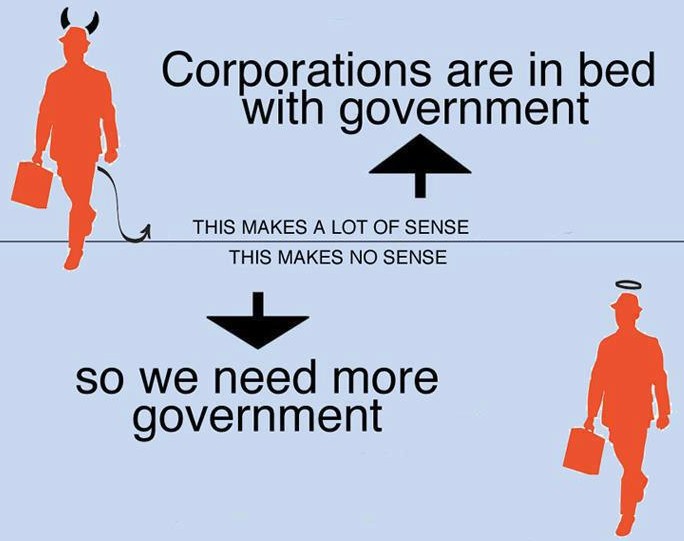

The role that regulation plays in crony capitalism is unappreciated. Critics of business assume that regulation is how government tames corporations. But historically, regulation has been how one set of businesses (usually bigger, well-connected ones) gains advantages over others.

If you wonder why, ask yourself: Which are more likely to be hampered by vigorous regulatory standards: entrenched corporations with their overstaffed legal and accounting departments or small startups trying to get off the ground?

Regulation can kill competition -- and incumbents like it that way. John Stossel was right when he said that crony capitalism was alive and well in North America.

Written by: Mark Borkowski is president of Toronto based Mercantile Mergers & Acquisitions Corporation. Mercantile specialize in the sale of mid market companies. He can be contacted at mark@mercantilema.com or www.mercantilemergersacquisitions.com